Diesel is a widely used fuel in India, powering everything from trucks and buses to cars and generators. However, the price of diesel has been steadily rising in recent years, making it a burden for consumers and businesses alike.

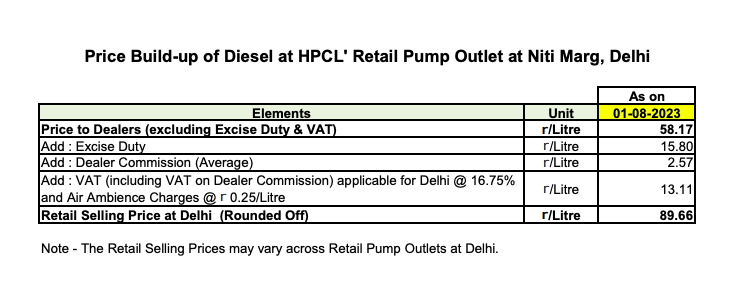

The price build-up of diesel at HPCL’s Retail Pump Outlet in Niti Marg, Delhi is as follows:

- Price to Dealers (excluding Excise Duty & VAT): Rs. 58.17/L

- Excise Duty: Rs. 15.80/L

- Dealer Commission (Average): Rs. 2.57/L

- VAT (including VAT on Dealer Commission) applicable for Delhi @ 16.75% and Air Ambience Charges @ Rs. 0.25/L: Rs. 13.11/L

- Retail Selling Price at Delhi (Rounded Off): Rs. 89.66/L

Taxes and cesses account for about 36% of the retail selling price of diesel in Delhi. This includes excise duty (17.6%), VAT (14.6%), and air ambience charges (0.3%).

The price build-up of diesel may vary slightly from state to state, depending on the applicable VAT rates and other local taxes.

Price build-up of diesel at HPCL’s Retail Pump Outlet

This table breaks down the price build-up of diesel at HPCL’s Retail Pump Outlet at Niti Marg, Delhi.

| Component | Price per Litre (in INR) |

|---|---|

| Price to Dealers (excluding Excise Duty & VAT) | 58.17 |

| Excise Duty | 15.80 |

| Dealer Commission (Average) | 2.57 |

| VAT (including VAT on Dealer Commission) | 13.11 |

| Air Ambience Charges | 0.25 |

| Retail Selling Price at Delhi (Rounded Off) | 89.66 |

Factors that contribute to the price build-up of diesel

There are a number of factors that contribute to the price build-up of diesel. These include the cost of crude oil, refining costs, taxes, and transportation costs.

Crude Oil:

The cost of crude oil is the biggest factor that affects the price of diesel. Crude oil is the raw material used to refine diesel, so any increase in the price of crude oil will lead to an increase in the price of diesel.

Refining Costs:

Refining costs are the costs associated with converting crude oil into diesel. These costs include the cost of labor, energy, and equipment.

Taxes:

Diesel is subject to a number of taxes, including excise duty, value-added tax (VAT), and state taxes. These taxes can account for a significant portion of the retail price of diesel.

Transportation Costs:

The cost of transporting diesel from refineries to retail outlets is also included in the price build-up of diesel. This cost can vary depending on the distance between the refinery and the retail outlet.

Impact of Price Build-up of Diesel:

The rising price of diesel has a number of negative impacts on the economy. It can lead to higher inflation, as businesses pass on the increased cost of diesel to consumers. It can also make it more difficult for businesses to compete, as they have to pay more for fuel.

For consumers, the rising price of diesel can lead to financial hardship. It can make it more expensive to commute to work and to transport goods. It can also make it more difficult to afford other essential expenses, such as food and housing.

Conclusion:

The price build-up of diesel is a complex issue with a number of contributing factors. The rising price of diesel has a number of negative impacts on the economy and on consumers. It is important to address the factors that contribute to the high price of diesel in order to reduce its burden on consumers and businesses.

Check – https://hindustanpetroleum.com/PriceBuildup

FAQ

Q1: What are the main factors that contribute to the price build-up of diesel?

A1: The main factors that contribute to the price build-up of diesel are:

- Cost of crude oil: Crude oil is the raw material used to refine diesel, so any increase in the price of crude oil will lead to an increase in the price of diesel.

- Refining costs: Refining costs are the costs associated with converting crude oil into diesel. These costs include the cost of labor, energy, and equipment.

- Taxes: Diesel is subject to a number of taxes, including excise duty, value-added tax (VAT), and state taxes. These taxes can account for a significant portion of the retail price of diesel.

- Transportation costs: The cost of transporting diesel from refineries to retail outlets is also included in the price build-up of diesel. This cost can vary depending on the distance between the refinery and the retail outlet.

Q2: How does the price build-up of diesel differ from state to state?

A2: The price build-up of diesel may vary slightly from state to state, depending on the applicable VAT rates and other local taxes. For example, the VAT rate on diesel in Delhi is 16.75%, while the VAT rate on diesel in Maharashtra is 26.6%. This difference in VAT rates will lead to a difference in the retail selling price of diesel in these two states.

Q3: What is the impact of the rising price of diesel on the economy and on consumers?

A3: The rising price of diesel has a number of negative impacts on the economy and on consumers. It can lead to higher inflation, as businesses pass on the increased cost of diesel to consumers. It can also make it more difficult for businesses to compete, as they have to pay more for fuel.

For consumers, the rising price of diesel can lead to financial hardship. It can make it more expensive to commute to work and to transport goods. It can also make it more difficult to afford other essential expenses, such as food and housing.